Victoria, British Columbia—Plurilock Security Inc. (TSXV: PLUR) (“Plurilock” or the “Company”), a leading provider of invisible and continuous authentication technologies for enterprises, today announces its fourth quarter and fiscal 2020 financial results for the periods ended December 31, 2020. All dollar figures are stated in Canadian dollars, unless otherwise indicated.

COVID-19 Impact on Operations and Financial Position

In March 2020, the World Health Organization declared the coronavirus (specifically identified as “COVID-19”) a global pandemic. The COVID-19 spread has had a limited impact on the Company’s operations. All employees have switched to working remotely during this time. The Company has resources available to fulfill its customers’ deliverables. The Company does not expect that the impact of COVID-19 will materially affect its business and financial results. The Company believes its response plan represents a positive contribution to society and the business community.

Fiscal 2020 Financial Highlights

-

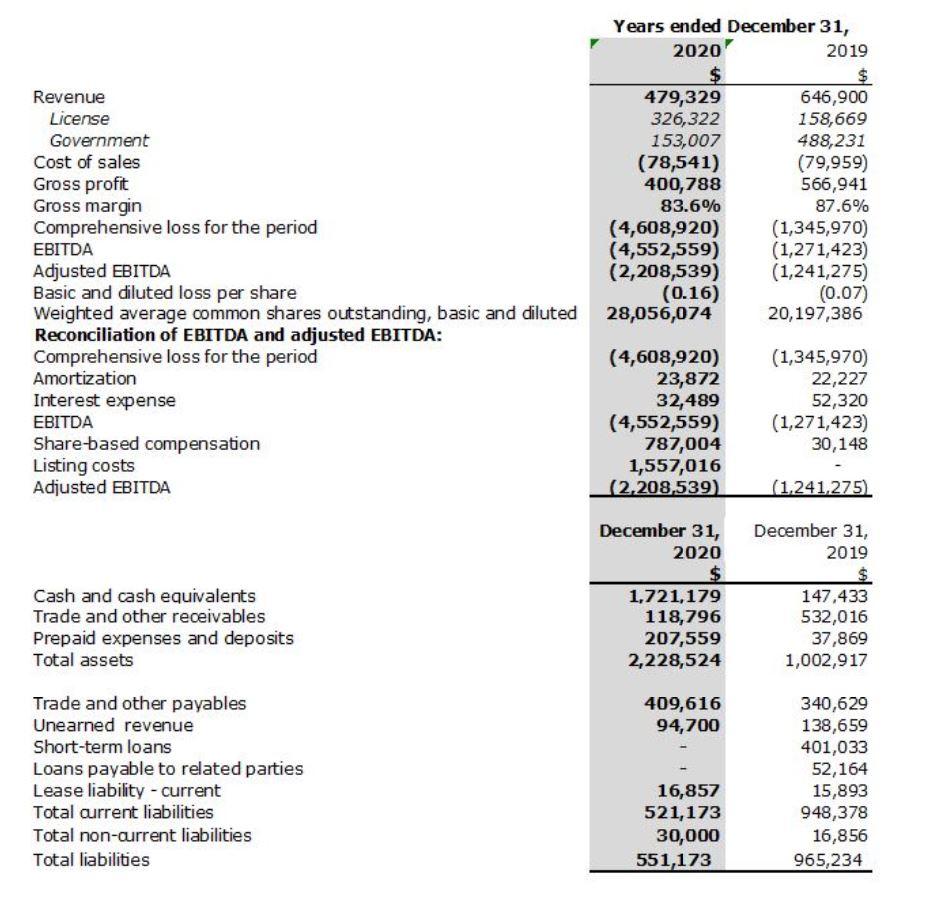

Total revenue for the year ended December 31, 2020 was $479,329 ($646,900 in 2019), a decrease of 26% over the prior fiscal year.

-

License revenue accounted for 68% of total revenues for the year ended December 31, 2020 (25% in 2019) while government revenue accounted for 32% of total revenues for the year ended December 31, 2020 (75% in 2019).

-

License revenue was $326,322 for the year ended December 31, 2020, compared to $158,669 in the prior fiscal year.

-

Government revenue was $153,007 for the year ended December 31, 2020, compared to $488,231 in the prior fiscal year.

-

Gross margin was 83.6% for the year ended December 31, 2020, compared to 87.6% in the prior fiscal year.

-

Adjusted EBITDA was $(2,208,539) for the year ended December 31, 2020 compared to $(1,241,275) in the prior fiscal year.

-

Cash used for operating activities for the year ended December 31, 2020 was $1,823,439, compared to $1,365,955 in the prior fiscal year.

-

Cash generated from financing activities for the year ended December 31, 2020 was $3,436,922, compared to $1,100,179 in the prior fiscal year.

-

Non-recurring listing costs and share-based compensation for the year ended December 31, 2020, in accordance with the Company’s public listing on the TSX Venture Exchange on September 24, 2020 were ($1,557,016) and ($787,004) respectively.

Fourth Quarter Fiscal 2020 Operational Highlights

-

On October 14, 2020, the Company announced the appointment of Gaétan Houle with 35 years of security leadership experience, as a Senior Advisor.

-

On November 10, 2020, the Company announced that it outsourced a federal sales agency, Government Sales Specialists, LLC (“GSS”) to leverage and optimize Plurilock’s existing federal government processes, assets, and relationships in order to grow Plurilock’s government sales funnel.

-

On November 18, 2020, the Company announced the launch of a new product collaboration with prominent open-source identity and access management (IAM) software vendor, Gluu, Inc.(“Gluu”).

-

On December 14, 2020, the Company announced the successful completion of the first of four milestones of a recent US$198,000 contract with the US Department of Homeland Security (“DHS”) Science and Technology Directorate’s Silicon Valley Innovation Program (“S&T SVIP”). Under the milestone, Plurilock received US$70,000 in funds.

-

On December 15, 2020, the Company announced new product features and enterprise-oriented infrastructure to Plurilock’s family of identity-centric cybersecurity products, including Plurilock’s ADAPT and DEFEND.

-

On December 16, 2020, the Company announced the appointment of Chris Pierce, with more than 30 years of success across the military, civil, intelligence, commercial and international markets focused on management and technology consulting, as a Senior Advisor.

-

On December 18, 2020, the Company announced that a major U.S. financial services firm had awarded a US$42,000 annual recurring contract to Plurilock to deploy the Company’s core authentication solutions.

“Fiscal 2020 was a difficult year across the industry due to the global pandemic,” said Ian L. Paterson, CEO of Plurilock. “Despite the headwinds of COVID-19, we were able to achieve our primary strategic objectives, which included a successful listing of Plurilock on the TSX Venture Exchange, capitalizing the company with $3.4 million in net financing proceeds, and laying the foundation for both organic and in-organic future growth. Most importantly, we were also able to grow our product licensing revenue by roughly 206% and increase our license revenue as a percentage of total revenue to 68% in fiscal 2020 from 25% in fiscal 2019. Furthermore, we have made several key additions to the team with notable cybersecurity leaders, which makes us well-positioned to capture new opportunities in this global market in 2021.”

Subsequent to the Year End:

-

On January 8, 2021, the Company secured a contract renewal with a U.S. Regional Bank for which the regional bank will continue to gain access to the Company’s core multi-factor authentication solutions.

-

On January 13, 2021, the Company announced the filing of a U.S. Provisional Patent application that covers user authentication during remote work sessions with time-based data.

-

On January 21, 2021, the Company listed its shares on the OTCQB Venture Exchange.

-

On January 29, 2021, the Company announced a Reseller Agreement with a U.K.-based distributor of cyber defence solutions, Tantallon Ltd., to deliver the Company’s solutions to a network of financial institutions outside North America.

-

On February 4, 2021, the Company announced the appointment of retired U.S. Navy Vice Admiral, Jan E. Tighe, who is currently an independent director on the boards of Goldman Sachs, as a member of the Company’s Advisory Board.

-

On February 26, 2021, the Company closed its second private placement and raised over $5.1 million in aggregate gross proceeds from the Company’s combined private placements.

-

On March 1, 2021, the Company obtained DTC eligibility.

-

On March 11, 2021, the Company completed its second milestone of a US$198,000 contract with the U.S. Department of Homeland Security (“DHS”).

-

On April 1, 2021, the Company completed its acquisition of Aurora System Consulting Inc., a provider of advanced cybersecurity technology and services based in California.

“Since the beginning of 2021, we have advanced our growth strategy, which is evidenced by Plurilock’s latest operational developments in recent months,” continued Ian L. Paterson. “Our most notable accomplishment includes the recent acquisition of Aurora Systems Consulting Inc, a leading provider of cybersecurity solutions with revenues of approximately US$28.1 million in 2020 and a client base that comprises over 140 top-tier clients.”

“As the global economy continues to adapt to an increasing number of security threats, our focus remains on expanding our operations across North America in order to deliver our advanced high margin software cybersecurity solutions to organizations that require safe remote work access for their employees and staff.”

Summary of Key Financial Metrics

|

To view an enhanced version of this table, please visit:

https://orders.newsfilecorp.com/files/7288/82189_table.jpg

Non-IFRS measures

This news release presents information about EBITDA and Adjusted EBITDA, both of which are non-IFRS financial measures, to provide supplementary information about operating performance. Plurilock defines EBITDA as net income or loss before interest, income taxes, depreciation and amortization. Adjusted EBITDA removes non-cash share-based compensation and listing expenses from EBITDA. The Company believes that EBITDA and Adjusted EBITDA is a meaningful financial metric for investors as it adjusts income to reflect amounts which the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives. EBITDA and Adjusted EBITDA are not intended as a substitute for IFRS measures. A limitation of utilizing these non-IFRS measures is that the IFRS accounting effects of the adjustments do in fact reflect the underlying financial results of Plurilock’s business and these effects should not be ignored in evaluating and analyzing Plurilock’s financial results. Therefore, management believes that Plurilock’s IFRS measures of net loss and the same respective non-IFRS measure should be considered together. Non-IFRS measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Readers should refer to the Company’s most recently filed MD&A for a more detailed discussion of these measures and their calculation.

Annual Filings

Management’s Discussion and Analysis and Consolidated Financial Statements and the notes thereto for the fiscal period ended December 31, 2020 can be obtained from Plurilock’s corporate website at www.plurilock.com and under Plurilock’s SEDAR profile at www.sedar.com.

About Plurilock

Plurilock is a cybersecurity company that provides advanced and continuous authentication for standards and regulatory compliance. Plurilock’s software leverages state-of-the-art behavioral-biometric, environmental, and contextual technologies to provide invisible, adaptive, and risk-based MFA solutions with the lowest possible cost and complexity. Plurilock enables organizations to compute safely-and with peace of mind.

For more information, visit https://plurilock.com or contact:

Ian L. Paterson

Chief Executive Officer

ian@plurilock.com

212.780.3255

Roland Sartorius

Chief Financial Officer

roland.sartorius@plurilock.com

Prit Singh

Investor Relations

ir@plurilock.com

905.510.7636

Forward-Looking Statements

This press release may contain certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) which relate to future events or Plurilock’s future business, operations, and financial performance and condition. Forward-looking statements normally contain words like “will”, “intend”, “anticipate”, “could”, “should”, “may”, “might”, “expect”, “estimate”, “forecast”, “plan”, “potential”, “project”, “assume”, “contemplate”, “believe”, “shall”, “scheduled”, and similar terms. Forward-looking statements are not guarantees of future performance, actions, or developments and are based on expectations, assumptions and other factors that management currently believes are relevant, reasonable, and appropriate in the circumstances. Although management believes that the forward-looking statements herein are reasonable, actual results could be substantially different due to the risks and uncertainties associated with and inherent to Plurilock’s business. Additional material risks and uncertainties applicable to the forward-looking statements herein include, without limitation, unforeseen events, developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately being inaccurate or irrelevant. Many of these factors are beyond the control of Plurilock. All forward-looking statements included in this press release are expressly qualified in their entirety by these cautionary statements. The forward-looking statements contained in this press release are made as at the date hereof and Plurilock undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.