VANCOUVER, BRITISH COLUMBIA – May 30, 2022 – Plurilock Security Inc. (TSXV: PLUR) (OTCQB: PLCKF) and related subsidiaries (“Plurilock” or the “Company”), an identity-centric cybersecurity solution provider for workforces, today announces its financial results for the three months ended March 31, 2022. All dollar figures are stated in Canadian dollars, unless otherwise indicated.

“During the first quarter of fiscal 2022, Plurilock increased its active sales pipeline as highlighted by its total revenue of $6.9 million for the three-month period,” said Ian L. Paterson, CEO of PlurilockTM. “Throughout this quarter, we achieved significant organic and inorganic growth through M&A, most notably, the acquisition of Integra Networks, a cybersecurity solutions provider with a large Canadian federal presence as well as strategic partnerships. Furthermore, we expanded our leadership and advisory team with the addition of two seasoned executives and advanced our zero-trust technology program by submitting two non-provisional U.S. patent applications and announcing a new product release for Spring 2022.”

Mr. Paterson added, “Overall, this quarter showcased our ongoing commitment to acquire profitable cybersecurity companies with top-tier customers, that can expand our operating margins and give us access to new distribution channels for cross-selling our software products as well as innovating new technology with an emphasis on zero-trust principles.”

Cyber risk continues to increase, with reported double-digit increases in the total number of data breaches reported for Q1 2022 as compared to Q1 2021.1 Credential compromise has also continued to be a significant threat vector, with a report that 20% of all data breaches are caused by compromised credentials during at least the initial phases of a cyber attack.2 For enterprises, cyber attacks pose a growing financial risk with estimates that cybercrime will hit $10.5 trillion by 2025, and that the cost of data breaches will increase from $3 trillion annually to more than $5 trillion annually by 2024.3,4

Outside of the U.S. Office of Management and Budget’s memo on the federal government’s shift to a zero trust infrastructure, several U.S. federal agencies are attempting to quell cyber attacks happening abroad in the Ukraine, working with Ukraine’s government agencies and critical infrastructure to bolster the country’s cyber resilience in the face of increased cyber attacks tied to ongoing conflict with Russia.5,6

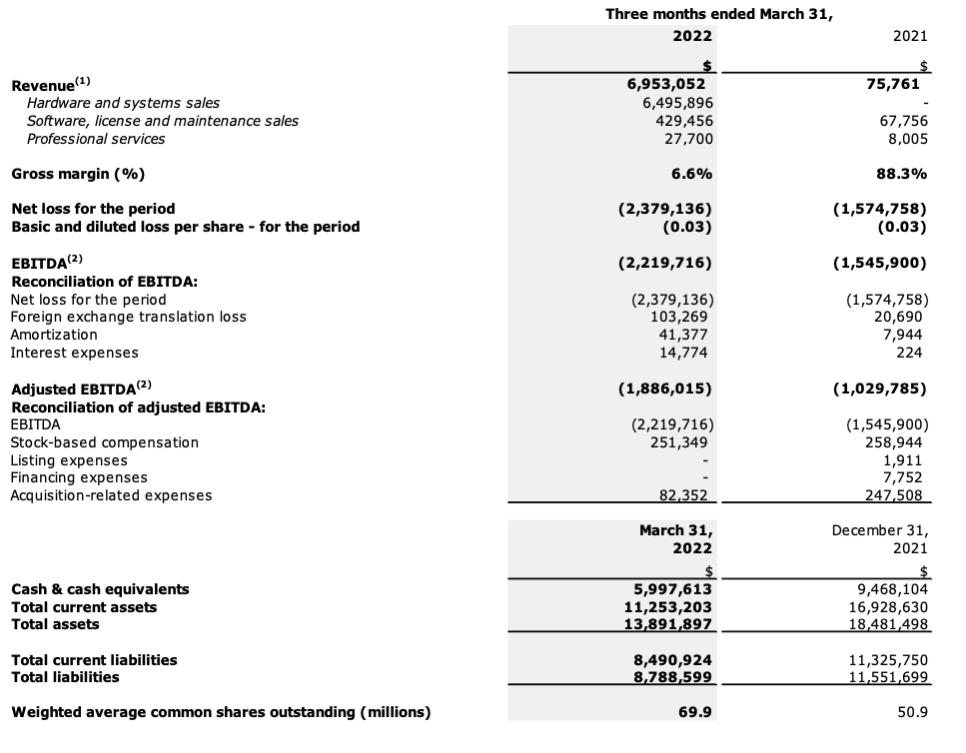

First Quarter Fiscal 2022 Financial Highlights

- Total revenue for the three months ended March 31, 2022 was $6,953,052 as compared to $75,761 for the three months ended March 31, 2021. The increase in total revenue was primarily due to the Solutions Division revenue generated from ASC for the three months ended March 31, 2022 and from INC since March 4, 2022 to March 31, 2022.

- Hardware and systems sales revenue for the three months ended March 31, 2022 totalled $6,495,896. No hardware and systems sales revenue was recorded in the prior year for the same period. Software, license and maintenance sales revenue for the three months ended March 31, 2022 was $429,456 compared to $67,756 in the prior year for the same period. Professional services revenue was $27,700 for the three months ended March 31, 2022 compared to $8,005 in the prior year for the same period.

- Hardware and systems sales revenues for the three months ended March 31, 2022 accounted for 93.4% of total revenues compared to nil % for the three months ended March 31, 2021. Software, license and maintenance sales revenues for the three months ended March 31, 2022 accounted for 6.2% compared to 89.4% for the three months ended March 31, 2021. Professional services revenue for the three months ended March 31, 2022 accounted for 0.4% of total revenues, compared to 10.6% for the three months ended March 31, 2021.

- Gross margin for the three months ended March 31, 2022 was 6.6% compared to 88.3% in the prior year for the same period.

- Adjusted EBITDA for the three months ended March 31, 2022 was $(1,886,015) compared to $(1,029,785) in the prior year for the same period.

- Cash & cash equivalents on March 31, 2022 was $5,997,613 compared to $9,468,104 on December 31, 2021.

- During the three months ended March 31, 2022, the Company used $4,501,599 of cash from operating activities compared to $1,158,455 in the prior year for the same period.

First Quarter Fiscal 2022 Operational Highlights

- On January 12, 2022, in connection with the online marketing services provided by AGORA Internet Relations Corp. (“AGORA”), the Company issued 53,809 common shares at a deemed price of $0.42 per share to AGORA as the first installment payment of $20,000 plus applicable taxes.

- On March 4, 2022, Plurilock acquired all the issued and outstanding shares of INC, a leading Canadian enterprise IT and cybersecurity solutions provider located in Ontario, Canada. Pursuant to the terms of the Share Purchase Agreement, the total consideration payable by the Company to the Vendor is $1,690,996 as follows: (i) $1,090,996 in cash; and (ii) 476,190 common shares of Plurilock, issuable at closing (the “INC Consideration Shares”) at $0.42 per Consideration Share, for a total value of $200,000 in Consideration Shares. $75,000 in cash and 178,571 INC Consideration Shares have been placed in escrow for 12 months to satisfy any indemnification obligations to the Company. Further, the Share Purchase Agreement includes future based performance-based earnout provisions, whereby up to $400,000 in common shares of Plurilock (the “INC Earnout Shares“) may be issued to the Vendor. The INC Earnout Shares will be issued at a deemed price equal to the closing trading price of the common shares of Plurilock on the TSXV on the date prior to announcement of the issuance of the INC Earnout Shares. The INC Consideration Shares are subject to certain contractual restrictions on trading for a period of 36 months from the date of issuance. On March 7, 2022, the Company issued 42,647 common shares (the “INC Consulting Fee Shares”) at a deemed price of $0.34 to a strategic consultant (the “INC Consultant”) of the Company for services provided by the INC Consultant to the Company in connection with the INC acquisition. The INC Consulting Fee Shares were issued pursuant to a consulting agreement dated August 1, 2020 between the Company and the INC Consultant. The INC Consulting Fee Shares are subject to a statutory hold period of four months plus a day from the date of issuance, in accordance with applicable securities law, ending July 12, 2022. At the date of the issuance of the consolidated financial statements, the initial accounting for the business combination is incomplete; therefore, no estimate of the financial impact of the transaction on the Company or the goodwill and other intangible assets to be recognized on acquisition can be provided.

- On March 8, 2022, the Company announced that ASC obtained a revolving line of credit from Crestmark, the Commercial Finance division of MetaBank®, N.A. (the “Lender“) for up to US$2 million (collectively, the “LOC“). The proceeds of the LOC will be used by ASC for working capital purposes. The LOC is secured against all current and future assets of the Company and its subsidiaries, PL., PLUS, and ASC.

- On March 15, 2022, the SBA announced that the COVID EIDL Loan installment payment start date was further deferred to thirty months from the COVID EIDL Loan date (“Second Revised Installment Start Due Date”). The Second Revised Installment Start Due Date is now December 9, 2022.

- On March 17, 2022, Plurilock announced the appointment of Brandon Swafford to its Advisory Board.

- On March 22, 2022, Plurilock announced the appointment of Tucker Zengerle as its Chief Operating Officer.

- On March 24, 2022, the Company granted 624,000 stock options to certain directors, officers and employees at an exercise price of $0.37 under the Plurilock Plan.

- On March 28, 2022, the Company announced that it had submitted a non-provisional patent application with the USTPO for a multi-device user identity confirmation technology enhancement.

Subsequent to First Quarter Fiscal 2022:

- On April 1, 2022, the Company appointed Garr Stepheson Jr. as the Chief Revenue Officer and granted him 800,000 stock options at an exercise price of $0.33 under the Plurilock Plan.

- On April 4, 2022, ASC, entered into a non-binding letter of intent to acquire all net assets from a regional USA-based IT & cybersecurity company (the “Asset Acquisition”). Closing of the Asset Acquisition is subject to the negotiation and entering into of a definitive agreement, the receipt of all applicable approvals (including the TSX Venture Exchange) and the satisfaction or waiver of all closing conditions. There is no assurance as of the date of this Condensed Interim Consolidated Financial Statements that the Asset Acquisition will be completed.

- On April 7, 2022, Plurilock announced that in accordance with the Share Purchase Agreement dated March 26, 2021 among the Company, PLUS and ASC, the performance-based earnout was achieved and the Company issued 1,154,676 common shares of the Company at $0.325 per share to the vendor in satisfaction of the earnout payment of US$300,000.

- On April 7, 2022, in connection with the online marketing services provided by AGORA, the Company issued 69,538 common shares at a deemed price of $0.325 per share to AGORA as the second installment payment of $20,000 plus applicable taxes.

- On April 22, 2022, the Company announced that its wholly-owned subsidiary, ASC, received a purchase order from a California-based pension fund for Plurilock’s DEFEND zero trust identity confirmation solution, representing the first cross-selling purchase order through ASC.

- On May 2, 2022, Plurilock announced the addition of Jennifer Swindell to its board of directors and granted Ms. Swindell 300,000 stock options at an exercise price of $0.26 per share under the Plurilock Plan.

Summary of Key Financial Metrics

Note:

(1) Revenue for the three months ended March 31, 2022, includes revenue from both the Technology Division and the Solutions Division since April 1, 2021 post ASC acquisition on March 31, 2021 and INC acquisition on March 4, 2022. Revenue for the three months ended March 31, 2021 only includes revenue from the Technology Division.

(2) Non-GAAP measure. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA should not be construed as alternatives to net income/loss determined in accordance with IFRS. EBITDA and Adjusted EBITDA do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company defines EBITDA as earnings before interest, taxes, and amortization. Adjusted EBITDA is defined as EBITDA before stock-based compensation, listing, financing and acquisition related expenses. The Company believes that EBITDA and Adjusted EBITDA is a meaningful financial metric for investors as it adjusts income to reflect amounts which the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives.

Non-IFRS measures

This news release presents information about EBITDA and Adjusted EBITDA, both of which are non-IFRS financial measures, to provide supplementary information about operating performance. Plurilock defines EBITDA as net income or loss before interest, income taxes, depreciation and amortization. Adjusted EBITDA removes non-cash share-based compensation and listing expenses from EBITDA. The Company believes that EBITDA and Adjusted EBITDA is a meaningful financial metric for investors as it adjusts income to reflect amounts which the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives. EBITDA and Adjusted EBITDA are not intended as a substitute for IFRS measures. A limitation of utilizing these non-IFRS measures is that the IFRS accounting effects of the adjustments do in fact reflect the underlying financial results of Plurilock’s business and these effects should not be ignored in evaluating and analyzing Plurilock’s financial results. Therefore, management believes that Plurilock’s IFRS measures of net loss and the same respective non-IFRS measure should be considered together. Non-IFRS measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Readers should refer to the Company’s most recently filed MD&A for a more detailed discussion of these measures and their calculation.

Quarterly Filings

Management’s Discussion and Analysis and Interim Condensed Consolidated Financial Statements and the notes thereto for the fiscal period ended March 31, 2022 can be obtained from Plurilock’s corporate website at www.plurilock.com and under Plurilock’s SEDAR profile at www.sedar.com.

About Plurilock

Plurilock provides identity-centric cybersecurity for today’s workforces. Plurilock offers world-class cybersecurity solutions paired with AI-driven, cloud-friendly security technologies that deliver persistent identity assurance with unmatched ease of use. The Plurilock family of companies enables organizations to operate safely and securely-while reducing cybersecurity friction.

For more information, visit https://www.plurilock.com or contact:

Ian L. Paterson

Chief Executive Officer

ian@plurilock.com

212.780.3255

Roland Sartorius

Chief Financial Officer

roland.sartorius@plurilock.com

Prit Singh

Investor Relations

prit.singh@plurilock.com

905.510.7636

Forward-Looking Statements

This press release may contain certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) which relate to future events or Plurilock’s future business, operations, and financial performance and condition. Forward-looking statements normally contain words like “will”, “intend”, “anticipate”, “could”, “should”, “may”, “might”, “expect”, “estimate”, “forecast”, “plan”, “potential”, “project”, “assume”, “contemplate”, “believe”, “shall”, “scheduled”, and similar terms. Forward-looking statements are not guarantees of future performance, actions, or developments and are based on expectations, assumptions and other factors that management currently believes are relevant, reasonable, and appropriate in the circumstances. Although management believes that the forward-looking statements herein are reasonable, actual results could be substantially different due to the risks and uncertainties associated with and inherent to Plurilock’s business. Additional material risks and uncertainties applicable to the forward-looking statements herein include, without limitation, unforeseen events, developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately being inaccurate or irrelevant. Many of these factors are beyond the control of Plurilock. All forward-looking statements included in this press release are expressly qualified in their entirety by these cautionary statements. The forward-looking statements contained in this press release are made as at the date hereof and Plurilock undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

- https://www.securitymagazine.com/articles/97431-92-of-data-breaches-in-q1-2022-due-to-cyberattacks

- https://www.ibm.com/security/data-breach

- https://cybersecurityventures.com/cybersecurity-almanac-2022/

- https://www.accenture.com/_acnmedia/PDF-165/Accenture-State-Of-Cybersecurity-2021.pdf

- https://www.whitehouse.gov/wp-content/uploads/2022/01/M-22-09.pdf

- https://pl.usembassy.gov/cybersecurity_ukraine/