● Record total revenue of $46.8 million for the nine-month period ended September 30, 2022, a 96% increase year over year

● Solutions Division reports net income of $0.9 million for the nine-month period ended September 30, 2022

● Significant client growth and technology portfolio expansion as a result of the two accretive acquisitions in Q3 Fiscal 2022

VANCOUVER, BRITISH COLUMBIA – November 21, 2022 – Plurilock Security Inc. (TSXV: PLUR) (OTCQB: PLCKF) and related subsidiaries (“Plurilock” or the “Company”), an identity centric cybersecurity solution provider for workforces, today announces its financial results for the three and nine months ended September 30, 2022. All dollar figures are stated in Canadian dollars, unless otherwise indicated.

“During the third quarter of fiscal 2022, Plurilock saw significant growth across the business as highlighted by our record revenue of $46.8 million for the nine-month period, and our completion of two accretive acquisitions,” said Ian L. Paterson, CEO of Plurilock. “Throughout this quarter, our sales pipeline continued to grow rapidly, and we have secured more customers for our high margin software solutions, most notably, with the Canadian Department of National Defence. This further validates our business model of driving customers to our owned software products. Futhermore, our Solutions Division has generated a net income of $0.9 million, which underscores our strategy to acquire profitable cybersecurity companies with reputable customers.

Mr. Paterson added, “As we scale our business, the priority is to continue enhancing our gross margins and reach breakeven in the near term. The recent acquisitions will enable us to potentially unlock new revenue and cost synergies that will improve our top and bottom-line. Additionally, with our increased line of credit, we intend to advance our M&A program to extend our distribution channels and technology infrastructure, and we are seeing numerous opportunities for accretive transactions in the marketplace. Overall, we are looking to expand all verticals of our business while maintaining cost-efficient operations.”

Third Quarter Fiscal 2022 Financial Highlights

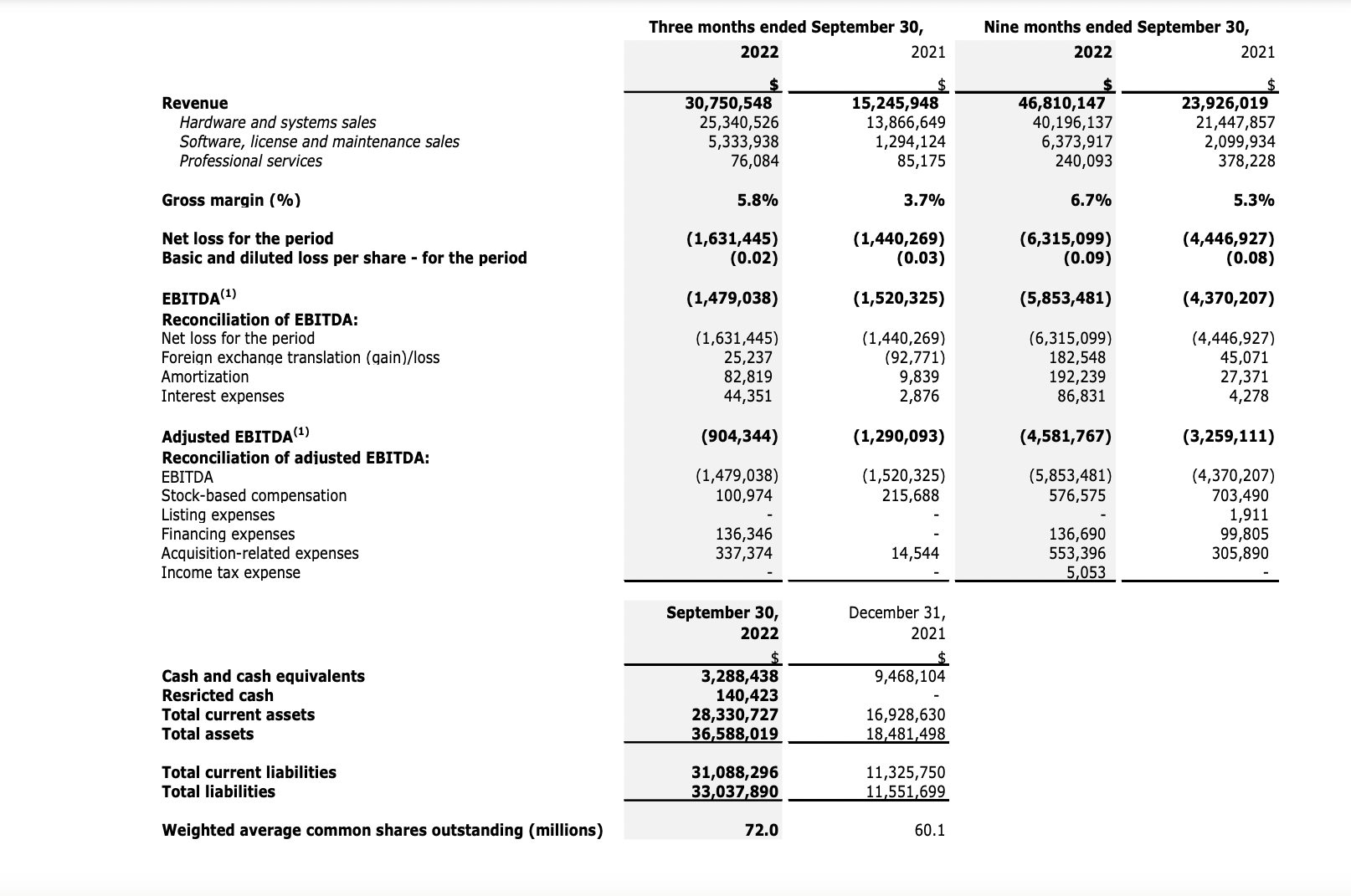

• Total revenue for the three and nine months ended September 30, 2022 was $30,750,548 and $46,810,147 respectively as compared to $15,245,948 and $23,926,019 for the same periods in the prior fiscal year ended September 30, 2021. Revenue for the three months ended September 30, 2022 and September 30, 2021 included revenue from both the Technology Division and the Solutions Division.

• Revenue for the nine months ended September 30, 2022 is significantly higher than the nine months ended September 30, 2021 in the prior year due to the timing of the acquisitions of Aurora Systems Consulting Inc. (“ASC”) and Integra Networks Corporation (“INC”) and the increase in sales revenue volume from the Technology Division.

• Hardware and systems sales revenue for the three and nine months ended September 30, 2022 totalled $25,340,526 and $40,196,137 respectively compared to $13,866,649 and $21,447,857 in the prior year for the same periods. Software, license, and maintenance sales revenue for the three and nine months ended September 30, 2022 was $5,333,938 and $6,373,917 respectively compared to $1,294,124 and $2,099,934 respectively in the prior year for the same periods. Professional services revenue was $76,084 and $240,093 respectively for the three and nine months ended September 30, 2022 compared to $85,175 and $378,228 respectively in the prior year for the same periods.

• Hardware and systems sales revenues for the three and nine months ended September 30, 2022 accounted for 82.4% and 85.9% respectively of total revenues compared to 91.0% and 89.6% for the three and nine months ended September 30, 2021. Software, license and maintenance sales revenues for the three and nine months ended September 30, 2022 accounted for 17.3% and 13.6% respectively compared to 8.5% and 8.8% for the three and nine months ended September 30, 2021. Professional services revenue for the three and nine months ended September 30, 2022 accounted for 0.3% and 0.5% respectively of total revenues, compared to 0.5% and 1.6% for the three and nine months ended September 30, 2021.

• Gross margin for the three and nine months ended September 30, 2022 was 5.8% and 6.7% respectively compared to 3.7% and 5.3% in the prior year for the same periods.

• Adjusted EBITDA for the three and nine months ended September 30, 2022 was $(904,344) and $(4,581,767) respectively compared to $(1,290,093) and $(3,259,111) in the prior year for the same periods.

• Cash and cash equivalents and restricted cash on September 30, 2022 was $3,428,861 compared to $9,468,104 on December 31, 2021.

• During the three and nine months ended September 30, 2022, the Company used $87,247 and $6,217,459 respectively of cash from operating activities compared to the Company generated cash of $1,904,265 and $327,717 in the prior year for the same periods.

Third Quarter Fiscal 2022 Operational Highlights

• On July 22, 2022, the Company announced a $2,500,000 Non-Brokered Private Placement of convertible debenture units (“Debenture Units”) at $1,000 per debenture unit (“Financing”). Each debenture will consist of C$1,000 principal amount of 10% unsecured convertible debenture of the Company with a maturity date of 48 months from the date of issuance, subject any forced conversion in certain circumstances and 500 common share purchase warrants. The Debentures are convertible at the holder’s option into common shares of the Company (the “Debenture Shares”) at a conversion price of $0.285 per Debenture Share. The Company intends to use the net proceeds received towards Plurilock’s acquisition pipeline and for general corporate purposes.

• On August 9, 2022, the Company announced the signing of a definitive agreement for (the “Asset Acquisition”) previously announced on April 4, 2022, with Atrion Communications, Inc. (“Atrion”) Pursuant to the terms of (the “Asset Acquisition”), the total consideration payable by the Company to Atrion is US$3,700,000 which includes US$2,000,000 in cash payable on closing, subject to working capital adjustment; US$500,000 in cash payable on the date that is 90 days following closing; and 1,285,700 common shares (“Plurilock Shares”) at CA$0.30 of Plurilock issuable at closing.

• On August 15, 2022, the Company announced the closing of the first tranche (the “First Tranche”) of the Financing, for aggregate gross proceeds to the Company of $1,245,000. In connection with the First Tranche, the Company paid in the aggregate of approximately $21,300 in cash commission and 74,735 of (the” Finder’s Warrant”).

• On August 23, 2022, the Company announced the first sale of the DEFEND product to Canadian Department of National Defence through Plurilock’s wholly-owned subsidiary INC.

• On August 29, 2022, the Company announced the completion of the acquisition of assets from CloudCodes Software Private Limited (“CloudCodes”), an award-winning cloud access security broker (“CASB”) based in India. The Company acquired certain assets pursuant to the terms of the definitive agreement and paid an aggregate consideration of US$1,508,803 of which US$700,000 paid on closing, a promissory note of US$300,000 and 992,755 common shares of Plurilock (the “Plurilock Shares”) at CA$0.59 per share. The Plurilock Shares were placed in escrow for 18 months to satisfy any indemnification obligations to the Company.

• On September 6, 2022, the Company announced that INC obtained a revolving line of credit from Pathward, National Association, a division of MetaBank®, N.A. (the “Pathmark”) for up to $1.5 million (“INC LOC”). The proceeds of the INC LOC will be used by INC for working capital purposes. The INC LOC is secured against all current and future assets of the Company and Integra.

• On September 9, 2022, Plurilock filed an amended and restated short form base shelf prospectus (the “Prospectus”), originally dated May 31, 2021, with securities regulators in each of the provinces and territories of Canada, other than Québec. The Prospectus, when made final and effective, will enable the Company to offer, issue and sell up to $50 million of common shares, warrants, subscription receipts, debt securities and units or a combination thereof from time to time, separately or together, in amounts, at prices and on terms to be determined based on market conditions at the time of the offering and as set out in an accompanying prospectus supplement, during the 25-month period that the Prospectus, when made final, remains valid. On September 13, 2022, Plurilock received receipt of approval from British Columbia Securities Commission for the amending and restating Prospectus.

• On September 21, 2022, the Company announced the closing of the second tranche (the “Second Tranche”) of the Financing for aggregate gross proceeds to the Company of $285,000. In connection with the Second Tranche, the company paid in the aggregate of approximately $15,000 in cash commission and 37,500 of Finder’s Warrant.

• On September 26, 2022, the Company completed the acquisition of Atrion (the “Asset Acquisition”) previously announced on April 4, 2022. Pursuant to the terms of the purchase agreement, the Company paid Atrion US$1,924,779 and issued 1,285,700 common shares of Plurilock Shares at CA$0.30 per share at closing. The Plurilock Shares issued or issuable under the terms of the Purchase Agreement are subject to a statutory hold period commencing on the date of issuance and shall expire on the date that is four months following the date of issuance. US$410,000 will be held in escrow for 18 months, subject to early release in certain circumstances, to stand as security for any claims of the Company with respect to the representations and warranties of Atrion contained in the Purchase Agreement. The Company will pay Atrion US$500,000 in cash payable 90 days following closing and US$410,000 will be held in escrow for 18 months to satisfy any indemnification obligations to the Company, as well as any purchase price adjustments pursuant to the terms of the purchase agreement. In addition, the Purchase Agreement includes future based performance-based earnout payments (“Earnouts”), whereby up to US$600,000 in cash may be paid to Atrion. The Earnouts are divided into three equal annual payments following the closing.

• On September 26,2022, the Company announced the increase of the Aurora line of credit (“ASC LOC”) from Pathward National Association, formerly known as Crestmark from US$2 million up to US$4 million. The proceeds of the increased ASC LOC were used by ASC to finance the Acquisition and for working capital purposes.

• On September 26, 2022, Plurilock announced the addition of Patrick Gorman to the Company’s Advisory Board and granted stock options for 150,000 common shares at an exercise price of $0.20 per share, which will vest over a period of four years from the grant date.

• During Q3 2022, the Company announced US $12.76 million in new orders and contracts which included multiple U.S governmental agencies such as the U.S. Department of Defense, U.S. Department of Energy, US library of Congress and as part of the National Aeronautics and Space Administration (“NASA”)’s Solution for Enterprise-Wide Procurement (“SEWP”) program, a United States Government Wide Acquisition Contract Vehicle (“GWAC”) that were announced on August 11, 2022 and September 15, 2022 respectively.

Subsequent to Third Quarter Fiscal 2022:

• On October 3, 2022, the Company announced it has entered into an amended and restated consulting agreement with a strategic consultant (the “Consultant”) whereby the Company has agreed to pay the Consultant a fee (the “Fee”) of $30,000 for services provided by the Consultant to the Company in connection with the Atrion acquisition. The Company intends to settle the Fee part in cash and common shares of the Company, whereby the Company will issue to the Consultant 78,947 common shares of the Company (the “Consulting Shares”) at a deemed price of $0.19 per Consulting Share. The issuance of the Consulting Shares is subject to TSXV approval.

• On October 4, 2022, in connection with the online marketing services provided by (“AGORA”), under the online marketing agreement entered into on December 30, 2021, the Company issued 237,895 common shares at a deemed price of $0.19 per share to AGORA as the third and fourth (final) installment payment of $40,000 plus applicable taxes. The parties have agreed to terminate the AGORA agreement as of September 30, 2022.

• On November 8, 2022, the Company made a payment in the amount of US$300,000 towards the aggregate consideration of the CloudCodes Acquisition (Note 4). The US$300,000 was recognized as a short-term loan (Note 16) on the condensed interim consolidated financial statements as of September 30, 2022 and was paid in full. Growth Outlook The Company’s executed strategic initiatives throughout the three and nine months ended September 30, 2022, has resulted in an extended technology portfolio and a broader distribution network, which increased sales growth and gross margins. To ensure continued rapid growth, Plurilock intends to implement a multi-pronged strategy with the goal of reaching cash flow break-even in the near term. Revenue and Cost Synergies Plurilock plans to streamline its operations and maximize cost efficiencies by unlocking revenue and cost synergies that can improve the company’s top and bottom line while optimizing costs. Synergistic and Accretive Acquisitions The acquisition of Aurora, Integra and certain assets of Atrion and CloudCodes, provided Plurilock with a large client network, cross-sale capabilities and new technology offerings. As a result, the Company plans to continue pursuing profitable M&A targets that can enhance its goto-market and sales capabilities. Summary of Key Financial Metrics

Growth Outlook

The Company’s executed strategic initiatives throughout the three and nine months ended September 30, 2022, has resulted in an extended technology portfolio and a broader distribution network, which increased sales growth and gross margins. To ensure continued rapid growth, Plurilock intends to implement a multi-pronged strategy with the goal of reaching cash flow break-even in the near term.

Revenue and Cost Synergies

Plurilock plans to streamline its operations and maximize cost efficiencies by unlocking revenue and cost synergies that can improve the company’s top and bottom line while optimizing costs.

Synergistic and Accretive Acquisitions

The acquisition of Aurora, Integra and certain assets of Atrion and CloudCodes, provided Plurilock with a large client network, cross-sale capabilities and new technology offerings. As a result, the Company plans to continue pursuing profitable M&A targets that can enhance its go-to-market and sales capabilities.

Summary of Key Financial Metrics

Note:

(1) Non-GAAP measure. Earnings before interest, taxes, depreciation and amortization (“EBITDA”) and Adjusted EBITDA should not be construed as alternatives to net income/loss determined in accordance with IFRS. EBITDA and Adjusted EBITDA do not have any standardized meaning under IFRS and therefore may not be comparable to similar measures presented by other issuers. The Company defines EBITDA as earnings before interest, taxes, and amortization. Adjusted EBITDA is defined as EBITDA before stock-based compensation, listing, financing and acquisition related expenses. The Company believes that EBITDA and Adjusted EBITDA is a meaningful financial metric for investors as it adjusts income to reflect amounts which the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives.

Non-IFRS measures

This news release presents information about EBITDA and Adjusted EBITDA, both of which are non-IFRS financial measures, to provide supplementary information about operating performance. Plurilock defines EBITDA as net income or loss before interest, income taxes, depreciation and amortization. Adjusted EBITDA removes non-cash share-based compensation and listing expenses from EBITDA. The Company believes that EBITDA and Adjusted EBITDA is a meaningful financial metric for investors as it adjusts income to reflect amounts which the Company can use to fund working capital requirements, service future interest and principal debt repayments and fund future growth initiatives. EBITDA and Adjusted EBITDA are not intended as a substitute for IFRS measures. A limitation of utilizing these non-IFRS measures is that the IFRS accounting effects of the adjustments do in fact reflect the underlying financial results of Plurilock’s business and these effects should not be ignored in evaluating and analyzing Plurilock’s financial results. Therefore, management believes that Plurilock’s IFRS measures of net loss and the same respective non-IFRS measure should be considered together. Non-IFRS measures do not have any standardized meaning prescribed by IFRS and are therefore unlikely to be comparable to similar measures presented by other companies. Readers should refer to the Company’s most recently filed MD&A for a more detailed discussion of these measures and their calculation.

Quarterly Filings

Management’s Discussion and Analysis and Interim Condensed Consolidated Financial Statements and the notes thereto for the fiscal period ended September 30, 2022 can be obtained from Plurilock’s corporate website at www.plurilock.com and under Plurilock’s SEDAR profile at www.sedar.com.

About Plurilock

Plurilock provides identity-centric cybersecurity for today’s workforces. Plurilock offers world-class cybersecurity solutions paired with AI-driven, cloud-friendly security technologies that deliver persistent identity assurance with unmatched ease of use. The Plurilock family of companies enables organizations to operate safely and securely-while reducing cybersecurity friction.

For more information, visit https://www.plurilock.com or contact:

Ian L. Paterson

Chief Executive Officer ian@plurilock.com

212.780.3255

Roland Sartorius

Chief Financial Officer roland.sartorius@plurilock.com

Prit Singh

Investor Relations prit.singh@plurilock.com

905.510.7636

Forward-Looking Statements

This press release may contain certain forward-looking statements and forward-looking information (collectively, “forward-looking statements”) which relate to future events or Plurilock’s future business, operations, and financial performance and condition. Forward-looking statements normally contain words like “will”, “intend”, “anticipate”, “could”, “should”, “may”, “might”, “expect”, “estimate”, “forecast”, “plan”, “potential”, “project”, “assume”, “contemplate”, “believe”, “shall”, “scheduled”, and similar terms. Forward-looking statements are not guarantees of future performance, actions, or developments and are based on expectations, assumptions and other factors that management currently believes are relevant, reasonable, and appropriate in the circumstances. Although management believes that the forward-looking statements herein are reasonable, actual results could be substantially different due to the risks and uncertainties associated with and inherent to Plurilock’s business. Additional material risks and uncertainties applicable to the forward-looking statements herein include, without limitation, unforeseen events, developments, or factors causing any of the aforesaid expectations, assumptions, and other factors ultimately being inaccurate or irrelevant. Many of these factors are beyond the control of Plurilock. All forward-looking statements included in this press release are expressly qualified in their entirety by these cautionary statements. The forward-looking statements contained in this press release are made as at the date hereof and Plurilock undertakes no obligation to update publicly or to revise any of the included forward-looking statements, whether as a result of new information, future events, or otherwise, except as may be required by applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.